INVESTING IN OUR FUTURE

What is the Cost Increase for the Average Taxpayer?

If approved, the bond referendum would result in the following estimated monthly tax impacts for a home valued at $300,000:

Question 1 is approximately a $5/month increase

Question 2 is approximately a $11/month increase

Q2 requires approval of Q1 in order to move forwardBoth questions combined are approximately a $16/month increase over the current tax rate

This investment takes advantage of expiring debt to reduce the overall impact on local taxpayers while allowing for significant improvements districtwide.

HOW WILL THE MONEY BE SPENT?

The projects included in the November 4 referendum were shaped through months of thoughtful, collaborative work involving our staff, School Board, and a 60-member Community Task Force—alongside guidance from our financial advisors and engineering firm. These experts bring deep experience in school facility planning and financing, and their involvement was critical in helping us design a responsible, community-driven plan with a minimal tax impact that will serve our students, families, and community for generations to come. This was a collective effort to ensure every element of the plan is thoughtful, needed, and fiscally sound.

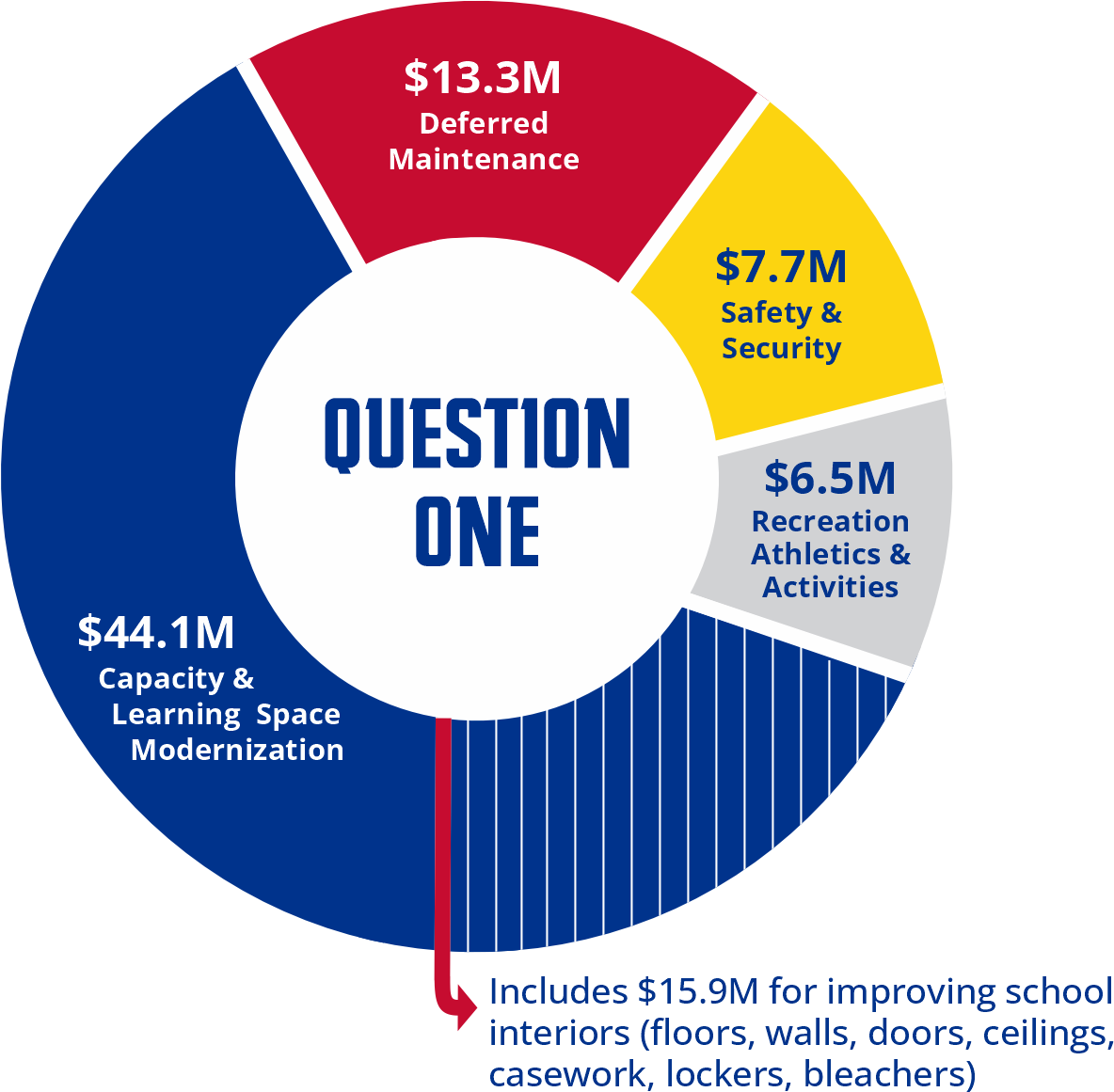

IF APPROVED, THE FUNDING WOULD BE SPLIT BETWEEN THE AREAS OF NEED SHOWN BELOW:

Please note that the above budgets are broken out by areas of need and do not include the inflation and cost issuance dollars outlined in the overall referendum budget. While this referendum website and FAQs provide a helpful overview, they can't fully capture the depth of the financial analysis and solutions that went into this process. If you would like to take a closer look, the District is more than happy to meet with anyone interested in reviewing the project scope and cost details.

Please do not hesitate to reach out. Click here to email us directly, and we will gladly set up a time to meet and review the details together.

Let's keep the conversation going—your questions, your voice, and your partnership matter!

WHY INVESTING NOW MATTERS?

-

Cambridge-Isanti Schools currently has voter-approved debt from past voter-approved facility investments that is being paid off. Without new bonds, that portion of the school tax would eventually decrease—currently about $34 per month on a home valued at $300,000. However, this reduction would not happen immediately. The savings would be phased in gradually over several years (through 2040) as different portions of the existing debt are retired. In other words, if the community chooses not to invest through this referendum, there would be no immediate drop in school taxes, only a slow decline over time. Meanwhile, the cost of inaction is far greater.

This referendum is not just a “district plan.” It is the community’s plan—shaped over years of conversations, study, and feedback from residents, parents, business owners, civic leaders, and nearly 60 members of our Community Task Force. The community has asked the district to move forward in this way because they do not want to face far more expensive problems down the road.

If the community does not invest now, our district will face:

Rising costs from inflation – Based on current construction inflation rates of 4–6% annually applied to a project of this scale, every year we delay adds roughly $6 million to the total cost.

Deferred maintenance turning into emergencies – aging roofs, heating/cooling systems, and infrastructure will fail, requiring costly emergency repairs that take funds away from teachers, classrooms, and programs.

Outdated and inefficient buildings – energy inefficiency and space limitations would grow, impacting learning, safety, and community access.

Missed opportunities – Grants, state matches, and partnerships are time-sensitive; delays mean losing outside funding and paying the full cost later.

In Minnesota, school districts receive about $1 per square foot from the state for facility upkeep—far below the $4 per square foot recommended by the Association of Physical Plant Administrators (APPA), a national organization that sets best-practice standards for managing and maintaining educational facilities. This gap has always been filled through community-approved bonds, which are the only way to keep facilities up-to-date and functioning. Without local support, facilities deteriorate quickly, and future repairs or rebuilds become far more expensive.

It’s also important to remember that school taxes are the smallest portion of most residents’ property tax bills. This referendum proposes that we continue the current level of school debt the community is used to, with a modest increase of $16 per month on an average household if both questions pass. By timing this new investment as old debt “falls off,” the district keeps taxes as consistent as possible, avoiding large swings—something our community has told us they value.

The financing plan for this referendum has been explained openly and consistently throughout our engagement process. The chart here, which illustrates how the new bond “wraps around” existing debt to minimize impact, has been included in:

Multiple Community Task Force meetings and publicly available slide decks.

Presentations to the Chamber of Commerce, youth organizational leaders, and local officials.

Numerous community information sessions and board updates.

This is not hidden information—community members can reference it in past meeting materials, on Cambridge-Isanti.FacilityFacts.org, and in public presentations. We believe in full transparency, and we welcome questions from anyone who wants to better understand why the community feels this investment is needed and how this investment will impact their taxes.

If we let the current debt expire without reinvestment, taxpayers may see a temporary reduction in school taxes—but the long-term consequences will be much more expensive, with reactionary fixes, and a gradual decline in the quality, safety, and competitiveness of our schools. This proposal reflects what our community has said they can afford and represents a proactive step to protect and enhance the schools that serve as the heart of our community.

Ultimately, this is a decision about timing and priorities—whether to address these needs now, while costs are lower and funding opportunities are available, or to wait and face potentially higher expenses in the future. This is our community’s plan, built by our community, for our community.

-

Investing in our school facilities is one of the most effective ways to strengthen our economy, attract new families and businesses, and improve quality of life for everyone in our community.

The proposed bond will generate $36.5 million in direct construction investment, creating an estimated 200–250 temporary construction jobs and producing more than $58 million in total economic activity through local spending during the build.

Once complete, the new field house and upgraded facilities will attract youth sports tournaments, club and travel team practices, and community events. These activities are projected to bring in over 8,700 visitors annually, each spending money locally on dining, shopping, and lodging—injecting more than $6.5 million over a ten-year period into our economy. That money doesn’t just pass through—it stays here, supporting restaurants, shops, hotels, and service providers, helping them expand, hire more workers, and reinvest in our community.

The updates to our Performing Arts Center are another important driver of economic activity. This is a regional asset that already attracts dance competitions, performers, and events from across the state and beyond. With these upgrades, we will be able to host more events and provide a significantly improved experience for participants and guests. These visitors often stay overnight, dine out, and shop locally—bringing significant additional revenue into our community.

Modern, high-quality schools also drive economic growth far beyond the classroom. Research backs this up:

A National Bureau of Economic Research study found that for every $1 invested in schools, home values increased by $20—benefiting all property owners, whether or not they have children in the schools.

When our schools are competitive, our community becomes more attractive to new households and new businesses—helping grow our local tax base and support essential services like parks, roads, and public safety without adding extra burden on current residents.

These facility improvements will also strengthen our ability to prepare students for the future. Expanded technical education, culinary arts, the healthcare industry, and other vocational opportunities will help our graduates step confidently into both college and careers. Many of our students choose to stay and work here after graduation, and these upgrades—paired with strong connections to local employers—will keep even more of our talent close to home. The new field house, athletic spaces, and PAC upgrades would further support student health, well-being, and creativity, ensuring our graduates are not just academically prepared, but also ready to contribute to our workforce and community life.

From creating jobs and attracting visitor spending, to building a career-ready talent pipeline and drawing in new residents and businesses, this bond will create a positive ripple effect across our entire community. It strengthens our schools, boosts local businesses, and improves life for everyone who calls Cambridge-Isanti home.

WHY INVEST IN MODERN LEARNING SPACES?

Investing in more modern learning environments is not about aesthetics; it’s about giving our students and educators the tools and settings they need to succeed. Whether it’s project-based learning, career-focused labs in areas like robotics or healthcare, or collaborative problem-solving exercises, modern learning spaces help prepare Bluejackets for the future. Just like a lab equips a scientist to do their best work, a modern classroom empowers Bluejackets to reach their full potential.